In the first 12 months of the COVID-19 pandemic, many large investment funds with environmental, social and governance criteria outperformed the broader market. One fund went from being among the poorest performers to the top of the list following tweaks to its portfolio.

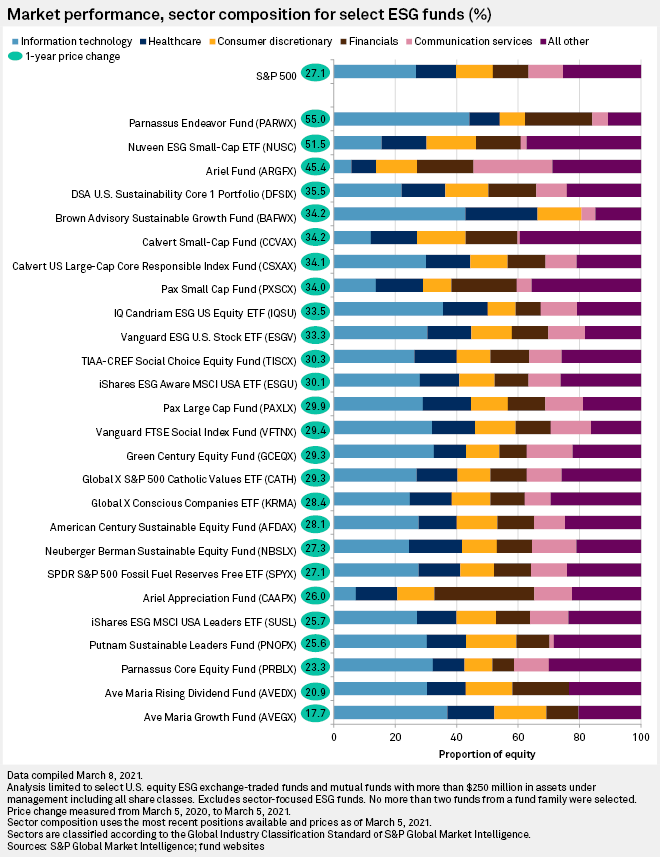

S&P Global Market Intelligence analyzed 26 ESG exchange-traded funds and mutual funds with more than $250 million in assets under management. We found that from March 5, 2020 — the month that the World Health Organization officially declared COVID-19 a pandemic — to March 5, 2021, 19 of those funds performed better than the S&P 500. Those outperformers rose between 27.3% and 55% over that period. In comparison, the S&P 500 increased 27.1%.

Funds that identify as "ESG-focused" screen for stocks based on value and growth like many other funds, but add various criteria such as ESG-focused governance practices, sustainability scores, disclosure practices, fossil fuel exposure, adherence to religious principles and workplace diversity.

Critics of ESG investing often question whether the strategy can deliver premium returns. But ESG fund managers have said their focus on nontraditional risks led to portfolios of companies that so far have been resilient during the COVID-19 downturn.

|

Meanwhile, investors are increasingly shifting their money into ESG funds. Flows into sustainable investment funds in the U.S. in 2020 reached $51.1 billion, which was more than double 2019 levels and a nearly 10-fold increase from flows into ESG funds in 2018, according to Morningstar Inc.

BlackRock Inc. CEO Larry Fink in his annual letter to CEOs in February noted this rapid increase in investments in sustainability-focused mutual funds and ETFs.

"The creation of sustainable index investments has enabled a massive acceleration of capital towards companies better prepared to address climate risk," Fink wrote. "As more and more investors choose to tilt their investments towards sustainability-focused companies, the tectonic shift we are seeing will accelerate further. And because this will have such a dramatic impact on how capital is allocated, every management team and board will need to consider how this will impact their company's stock."

The 26 ESG funds in our analysis all saw their performance improve in the first 12 months of the pandemic, although to varying degrees. One ETF — SPDR S&P 500 Fossil Fuel Reserves Free ETF managed by a unit of State Street Global Advisors Inc. — performed the same as the broader S&P 500. Six funds that underperformed relative to the S&P 500 saw a price increase ranging from 17.7% at the Ave Maria Growth Fund managed by Schwartz Investment Counsel Inc. to a 26% change for the Ariel Appreciation Fund managed by Ariel Investments LLC.

Parnassus Investments' Parnassus Endeavor Fund saw the biggest change over the year, increasing 55%. This was followed by Nuveen Fund Advisors LLC's Nuveen ESG Small-Cap ETF, which saw a 51.5% increase. The third-best performing fund in the group was Ariel Investments' Ariel Fund with a 45.4% increase.

A prior review by S&P Global Market Intelligence of a smaller set of 17 ESG funds in August 2020 found that all but three had outperformed the S&P 500 in the year to date. Those outperforming funds had been buoyed in part by their heavy weighting in large technology company stocks that had seen their own strong performance.

At that time, the Parnassus Endeavor Fund was the worst performer of the 17.

From doghouse to penthouse

So how did the Parnassus Endeavor Fund, which as of the end of 2020 managed about $38 billion in assets, go from the bottom of the heap in mid-2020 to the top at the start of this year? The answer involves a number of tweaks the firm made in recent months while maintaining its philosophy of investing in businesses that have "relevant products or services, sustainable competitive advantages, quality management teams and positive ESG profiles," according to its website.

For starters, Parnassus Investments founder and sustainable investing titan Jerome Dodson, who co-managed the fund along with senior research analyst Billy Hwan, in January 2021 stepped down from his leadership role in the firm, leaving Hwan solely in charge.

Since the mid-1980s, Dodson had become a big name in the sustainable investing space and was known for his Warren Buffett-style stock picking strategy that involved building up holdings in a few dozen companies in each of a handful of funds.

"When he found a company that he liked, he would double, triple down on it," said Hwan in an interview.

That concentrated stock strategy would sometimes lead to big swings in performance. While the trend was often positive over the longer term, Hwan said some investors expressed concerns about those swings.

During the pandemic, Dodson was "ever the optimist" and believed that "America will overcome" the crisis, while Hwan said he worried the impact would be much bigger. "I was right in the short run because things got a lot worse than any of us expected, but then he was right in the longer run," Hwan said.

As a result, from March to December 2020, "we actually didn't shift the portfolio that much," Hwan explained. "I remember when things were falling, we were very happy with the stocks that we had, even though we weren't happy that the prices were going down." One of the smaller changes the fund did make during that time was to drop its holdings in Alaska Airlines Inc. in October.

"Airlines were one of the hardest-hit industries," Hwan said. "It became clear that there would be demand destruction for quite some time in passenger volumes and also because of just better opportunities that have more upside in the shorter term."

But the biggest move came in January 2021. After Dodson stepped down, the fund increased the number of companies in its portfolio to 36 from 28.

Notably, Hwan drew down some of the fund's double-digit stock holdings in semiconductor companies Micron Technology Inc. and Applied Materials Inc. — a part of the technology sector the fund had built up its stake in since late 2018 — and put that money toward diversifying the portfolio. Some of the companies Hwan added include Verizon Communications Inc., The Bank of New York Mellon Corp., financial technology company Intuit Inc., healthcare and pharmaceutical company Novartis AG, healthcare technology company Cerner Corp. and payroll processing and administration company Paychex Inc.

Active managers, but not activists

As for how the fund incorporated sustainability and ESG-related decisions into its stock picks, Hwan explained that it uses a number of factors including information from third-party data providers and stock analysis reports from TheStreet Inc.

"Basically, we can kind of kick the tires on the company, including talking to the management, competitors and customers," Hwan said. He looks for "companies that have some type of sustainable competitive advantage, that are run by capable capital allocators, that have some product risk service that's unique to the market that people want more of over time. So that, I think, gives us a good foundation for picking stocks that are better than average, that will do better than average over the long term."

And while the fund engages with companies on ESG issues, Hwan insists that "we're active managers, we're not activist managers."

"Once we decide to invest in the company, there are a lot of things that we do on the ESG side ... to engage with the company to try and make them a better ESG player," he said. For example, Parnassus sends the company an engagement letter that talks about details the fund manager learned during the due diligence process and raises issues and questions in areas that Parnassus thinks could be improved.

Most companies respond to the inquiry "to flush out those details and think about kind of what concrete steps that they can take," Hwan said.

He acknowledged that the fund is overweight in information technology and financial companies — even compared to the S&P 500 — but he said that is intentional. The fund believes technology companies represent a long-term growth opportunity. And he said one of the fund's largest components within financials is in consumer credit companies. "They've been overly punished on the way down, particularly last year when people thought that unemployment would lead to huge amounts of credit losses. But that ... didn't turn out to be the case," Hwan said.

And those kinds of investments fit well with the fund's strategy, he added.

"As value investors, we say, 'What has been overly punished in the market or what's out of favor or ignored?' And if you go through those groups of stocks or those sectors: 'Is there anything where people [have] thrown the baby out with the bathwater?' And try to identify those hidden gems."